Guide to Layered Process Audits (LPA)

Introduction to Layered Process Audit

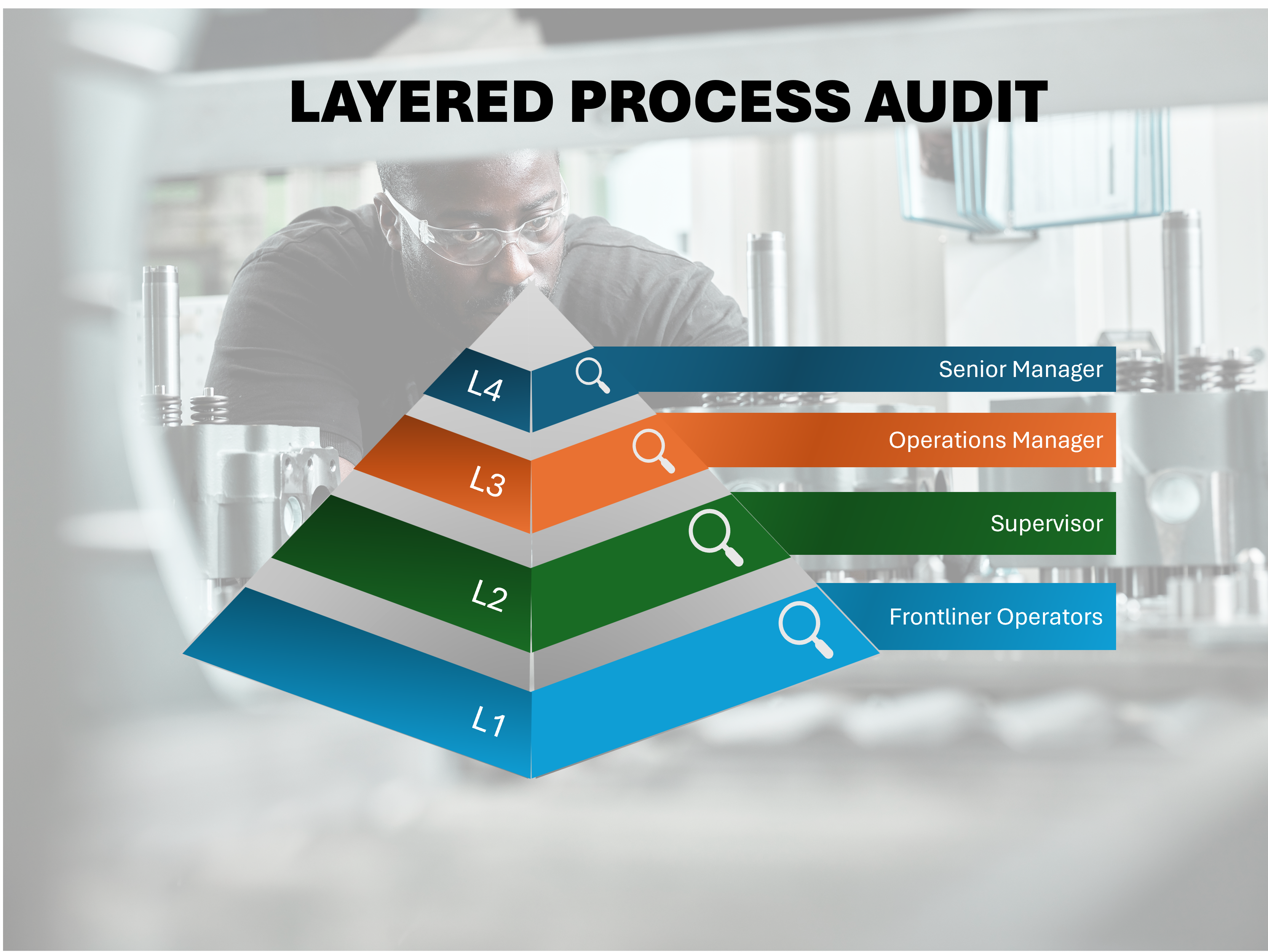

Layered process audits (LPAs) are the ones that are conducted across multiple levels of the organization to provide layers of protection against rework, product recalls, and compliance failures. Going by the definition, two key factors distinguish the layered process audits from the other types of audits. These are:

- Audits focus on how the processes are carried out and not just the outcome of the process,

- The same audits are conducted by different levels in an organization involving frontline staff, middle management & top management.

The purpose of the LPA is to ensure that the high-risk steps ( which can cause costly mistakes), comply with the laid down quality standards or procedures. A Layered Process Audit places people at multiple levels of the organization “where the work is being done”. By doing so, the process gaps are proactively identified and plugged before they can cause significant harm to the business. In a nutshell, it is a preventive approach to quality management as against the corrective approach.

Benefits of Layered Process Audits

The key benefits of following LPA are:

- Identifying Process Weakness: One of the primary benefits of LPAs lies in their capacity to uncover hidden process weaknesses. By subjecting each layer of the production process to scrutiny, businesses can pinpoint vulnerabilities and potential points of failure, allowing for proactive rectification.

- Risk Mitigation: No process is 100% risk-free. Even conducting periodic audits based on sampling leaves a scope for residual risks. I am sure you would have heard or read about the automotive OEMs recalling vehicles due to quality issues. LPA, if implemented correctly, could significantly reduce the residual risks and thereby instances of recall & reworks.

- Reduction in Cost of Poor Quality: It is a well-known fact that as the detection of poor quality moves up in the value chain, its cost increases. In other words, the poor quality detected early on is less expensive to rectify as compared to the one detected later. The LPA focuses on detecting poor quality early in the process before more value is added to it.

- Cultivating the Culture of Improvement: The involvement of employees in assuring compliance & taking proactive steps fosters a culture of excellence. As a result, the employees at all levels are involved in process improvements & implementing preventive controls.

- Increased Discipline: By involvement in the LPA, the frontline operators are more cautious and sensitive towards the quality standards. It makes them more disciplined in following the right steps and not taking shortcuts.

- Increased Interaction between Plant Management & Line Operators: Since all the levels are following the same audit checks, it ensures better communication & constructive interactions.

Steps involved in implementing Layered Process Audits

Implementing Layered Process Audits (LPAs) requires a thoughtful and strategic approach. The effectiveness of Layered Process Audits hinges on meticulous planning. Optimal planning is achieved through a multidisciplinary approach, incorporating active management participation. Six crucial factors merit consideration in this planning process:

- Identify the Processes for the LPA: A cross-functional team identifies existing key process steps to audit. These are selected based on risk to product quality including safety, criticality of process step, or product characteristic. Layered Process Audit items can also include past non-conformances, past customer returns, and past customer complaints

- Assemble a Team of Auditors: Identify the stakeholders including the workers, supervisors, and manager accountable for a given process. Train them on the audit procedure using standardized procedures and tools. Assign them clear roles & responsibilities for the LPA program. These “auditors” do not need Quality Management System auditor training since they are not Quality Management System auditors.

- Develop a Checklist for each process and layer, based on key performance indicators and high-risk areas. In developing an Audit check sheet, remember that it should include specific, critical items that can be verified quickly. Therefore, the more focused the Audit check-sheet, the more effective. A Layered Process Audit should not be a laundry list of all requirements within a production cell or department.

- Determine Audit Cadence: Define the audit frequency and schedule for each layer. Ensure that audits are conducted at different times and by different people, as per the LPA plan. The closer the auditor is to the level of the area being audited, the more frequently that auditor will conduct the Audit. For example, a line supervisor may conduct the Audit daily, while the plant manager may conduct the Audit once per month. Customer specifics may require particular audit frequencies.

- Select the Appropriate Technology: Select & implement a tool e.g. SIMSA to manage the audit process. Ensure that the tool covers all the steps of the PDCA cycle and automates the manual tasks related to the audits. It should have features for auto-scheduling the audits based on the defined frequency, recoding and assigning the corrective actions, and auto-reminders for the followups.

- Set up LPA Governance Process: It is the upper management team’s responsibility to assess and improve the effectiveness of the LPA process. Operations managers must ensure the following:

• Layered Process Audits are conducted on time,

• Layered Process Audits are conducted by the designated team members,

• The results are recorded and reviewed regularly,

• Resources are available and focused on corrective actions for the non-conformances identified.

What Layered Process Audits are NOT?

- A quality audit owned by the Quality Department.

- Measurement of parts or part characteristics using instrumentation.

- A long “laundry list” of items that include items not contributing to customer satisfaction.

- Allowed to be delegated to other persons.

- Conducted as & when time permits.

- Done in the office or away from the place of action.

- Audits in which the corrective actions are taken with a time lag.

- A method to police or penalize the employees.

- A replacement for Quality Management System audits.

Critical Success Factors for the LPAs

- Discipline: Management must instill discipline early in the process to ensure the timely completion of Audits. Consistency fosters discipline within the organization and serves as a demonstration of management’s commitment to Layered Process Audits.

- Quick and Manageable: The audits should be short and should not take too long, as well as take away focus from the critical areas.

- Recording Outcomes: The outcomes of every Layered Process Audit must be documented and preserved. While the primary aim of these audits is to guarantee ongoing adherence to the process, they also serve as a valuable tool for fostering continuous improvement. This is achieved by implementing corrective actions aligned with non-conformances identified during Layered Process Audits.

- Continuous Improvement: Each non-conformance found should be considered as an opportunity for improvement. The improvements should be taken up on an immediate basis as any delay may cost the business and expose to various risks.

Conclusion

Layered Process Audits prove highly effective in upholding process enhancements and embedding critical process steps into the organizational fabric. This efficacy stems from the comprehensive participation across all organizational levels, spanning from operators to senior managers. The dynamic interaction between managers and operators during these audits becomes a valuable learning opportunity. Managers gain insights into manufacturing processes from operators, while operators glean essential knowledge about factors crucial for customer satisfaction from managers. Layered Process Audits facilitate this bidirectional communication.

Numerous organizations grapple with challenges related to 1) communication, 2) consistent adherence to standardized process steps, 3) sustaining and embedding corrective actions, and 4) disseminating customer satisfaction requirements throughout all organizational tiers. The implementation of Layered Process Audits, as outlined in this guideline, effectively addresses these multifaceted issues.