Re-imagining Operational Audits in Post Pandemic World

The COVID-19 pandemic has had a profound impact on businesses worldwide, disrupting supply chains, altering consumer behavior, and challenging traditional ways of working. As organizations adapt to the “new normal,” operational audits have become more critical than ever. In this blog, we will explore the role of operational audits in a post-pandemic world and how they can help businesses navigate this challenging environment.

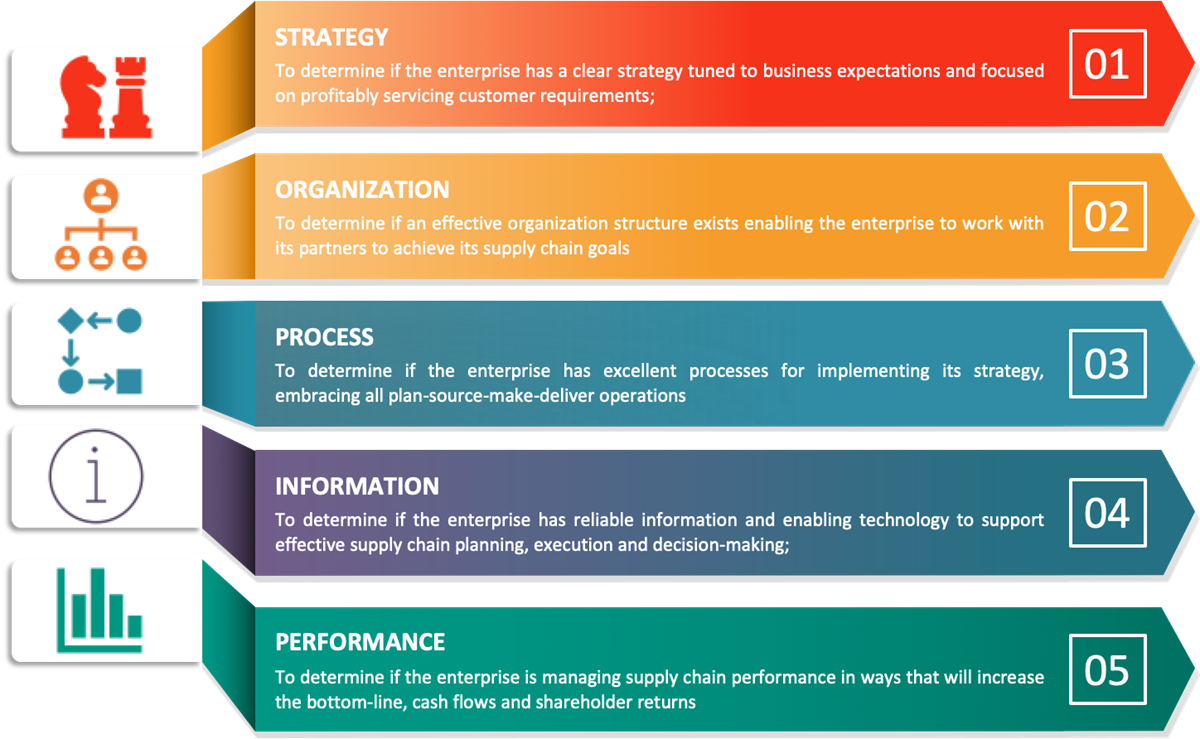

Operational audits are a systematic and objective assessment of an organization’s operations, processes, and controls. They are designed to evaluate the effectiveness of the organization’s risk management strategies, identify areas of inefficiency, and provide recommendations for improvement. Operational audits can cover a wide range of areas, including financial operations, IT systems, supply chain management, and health and safety practices.

The pandemic has created significant disruptions across all industries, forcing businesses to adapt to rapidly changing conditions and new ways of working. These disruptions have also impacted the way operational audits are conducted, with many businesses facing new challenges in the audit process.

One of the biggest challenges faced by businesses is the need to conduct audits remotely. With many employees working from home, auditors have had to rely on digital communication tools to conduct interviews and gather information. This has created new challenges around data security and privacy, as well as communication and collaboration between auditors and auditees.

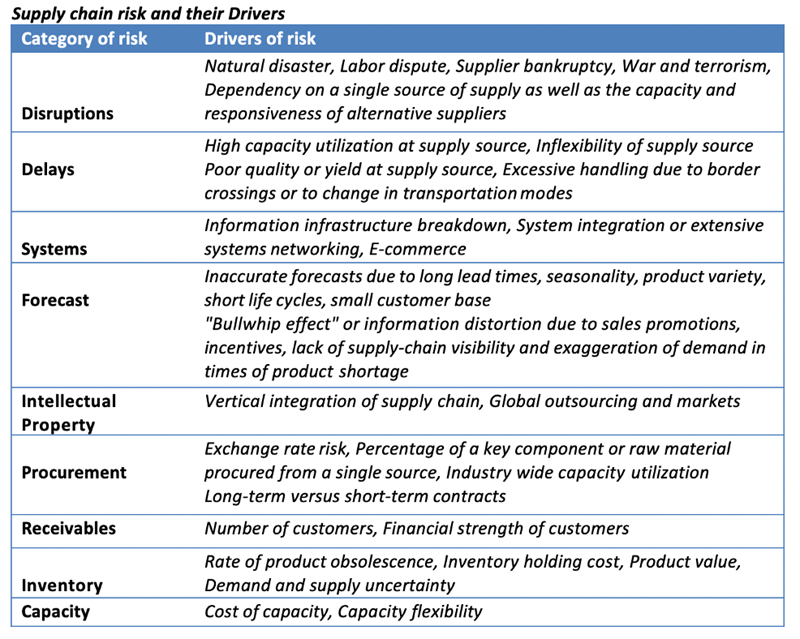

Another challenge faced by businesses is the need to assess new risks and vulnerabilities created by the pandemic. For example, businesses may need to evaluate the risks associated with remote work, such as data security and employee productivity. Additionally, the pandemic has created new risks around supply chain disruption, employee health and safety, and compliance with government regulations.

Despite these challenges, operational audits remain a critical component of effective risk management in the post-pandemic world. By leveraging the right tools and strategies, businesses can conduct audits effectively and efficiently, identify and mitigate new risks, and improve overall operational efficiency.

Operational Audits are more important than ever

In a post-pandemic world, operational audits have become essential for several reasons. Firstly, the pandemic has led to significant changes in business operations, with many companies adopting remote work arrangements, altering supply chain strategies, and implementing new safety protocols. Operational audits can help organizations assess the effectiveness of these changes and identify any new risks that have emerged.

Secondly, the pandemic has created new risks and challenges for businesses. Supply chain disruptions, cybersecurity threats, and employee health and safety concerns are just a few examples of the new risks that organizations are facing. Operational audits can help businesses identify these risks and develop strategies to mitigate them.

Finally, the pandemic has heightened the need for transparency and accountability. With stakeholders, including employees, customers, investors, and regulators, demanding more information about how organizations are managing risk, operational audits can help provide assurance that proper controls and processes are in place.

Role of Technology in Operational Audits post-pandemic

Technology plays a crucial role in operational audits, especially in a post-pandemic world. With remote work arrangements becoming more prevalent and businesses increasingly reliant on digital systems and processes, technology has become an essential tool for operational auditors. Here are a few ways in which technology can support operational audits in a post-pandemic world:

1. Remote Auditing: Technology can enable auditors to conduct remote audits, reducing the need for in-person interactions and allowing audits to be conducted safely and efficiently. Remote auditing tools can include video conferencing, screen sharing, and remote access to systems and data.

2. Data Analytics: Technology can help auditors analyze large volumes of data quickly and accurately, identifying patterns and anomalies that may indicate areas of risk or inefficiency. Data analytics tools can include data visualization software, artificial intelligence, and machine learning algorithms.

3. Automation: Technology can automate many of the tasks associated with operational audits, freeing up auditors to focus on higher-value activities. Automation tools can include robotic process automation, workflow management software, and electronic document management systems.

4. Collaboration: Technology can enable auditors to collaborate more effectively, even when working remotely. Collaboration tools can include cloud-based project management software, virtual whiteboards, and chat applications.

5. Security: Technology can help auditors ensure the security of their audit data and protect against cyber threats. Security tools can include encryption software, multi-factor authentication, and network monitoring tools.

In addition to these specific tools and technologies, the use of technology can also help auditors to work more efficiently, reduce costs, and increase the speed and accuracy of audits. For example, technology can automate many of the routine tasks associated with audits, such as collecting data and generating reports, allowing auditors to focus on more strategic and analytical activities.

In conclusion, operational audits are more critical than ever in a post-pandemic world. They can help businesses navigate the challenges and risks posed by the pandemic, evaluate the effectiveness of new operational strategies, and ensure ongoing compliance with relevant regulations and standards. By providing transparency and accountability, operational audits can also help businesses build trust with stakeholders and maintain their reputation in a challenging environment.